Pitney Bowes Maps – Pitney Bowes has sold a controlling interest in the entities representing a substantial majority of the global e-commerce (GEC) segment operating in the US to Hilco Commercial Industrial, an affiliate . Pitney Bowes (NYSE: PBI) has agreed to liquidate much of its money-losing e-commerce business with the help of Hilco Global. Investors are cheering the news, sending Pitney Bowes shares up as much .

Pitney Bowes Maps

Source : mapsplatform.google.com

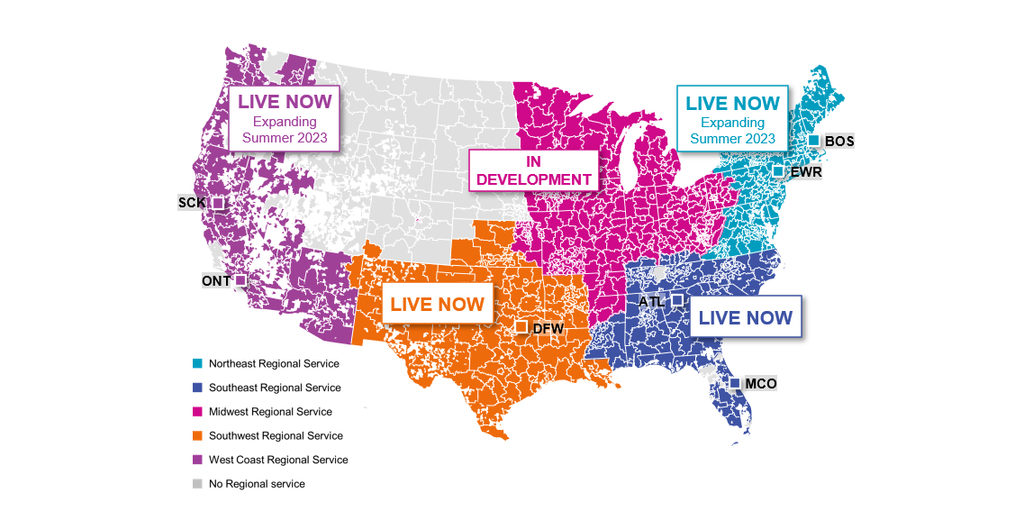

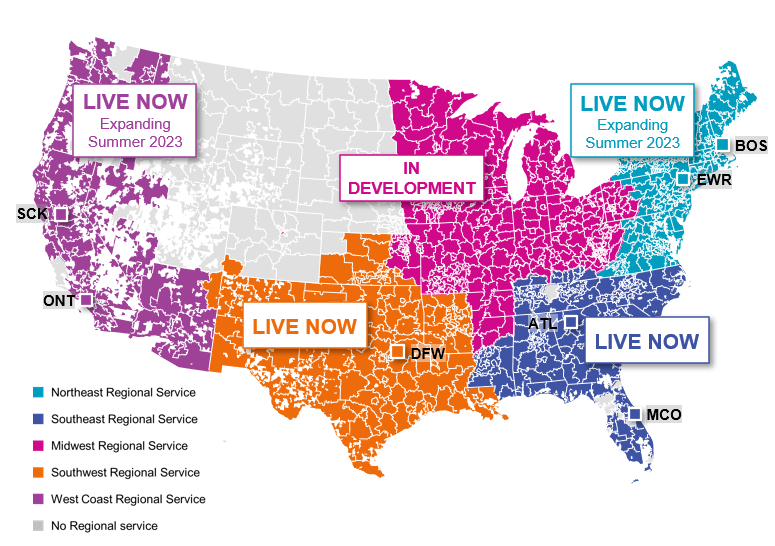

Pitney Bowes rolling out fast delivery to 20 more cities | Chain

Source : chainstoreage.com

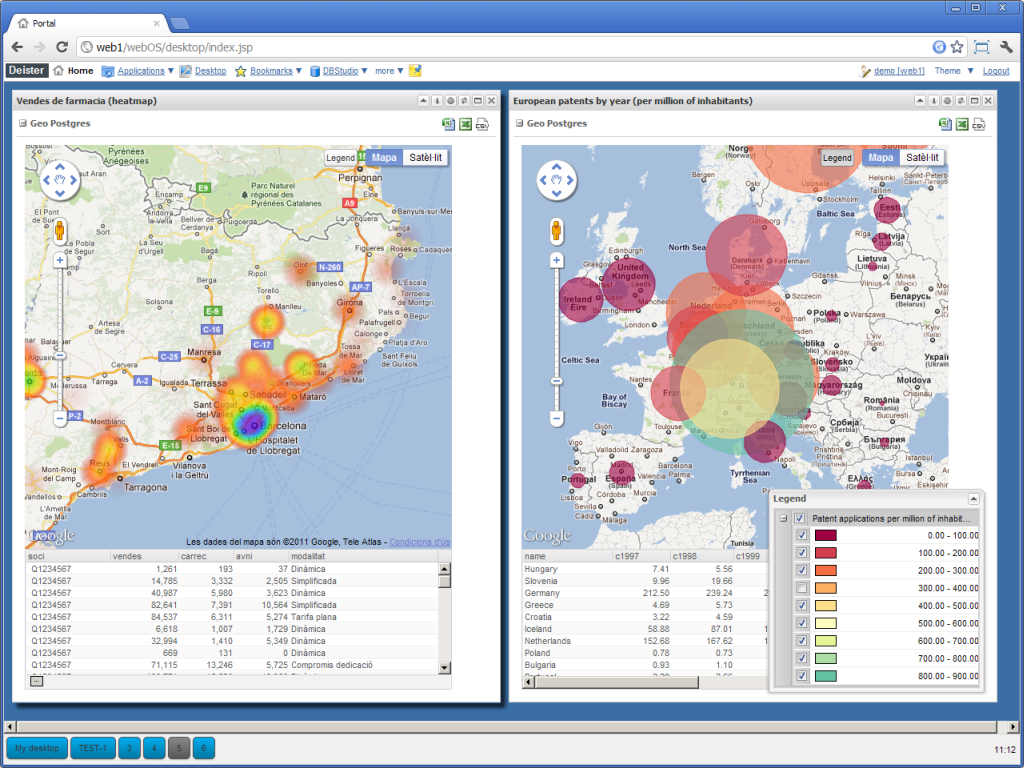

TomTom, Pitney Bowes to work together for location based

Source : www.geospatialworld.net

Pitney Bowes expanding service | HBS Dealer

Source : hbsdealer.com

Pitney Bowes expands regional delivery network for e commerce

Source : www.dcvelocity.com

Blog: Introducing Last Mile Fleet Solution: Maximize fleet

Source : mapsplatform.google.com

Charting New Terrain in eCommerce with Pitney Bowes

Source : carto.com

Blog: Introducing Last Mile Fleet Solution: Maximize fleet

Source : mapsplatform.google.com

How to get to Pitney Bowes in Brown Deer by bus?

Source : moovitapp.com

Pitney Bowes Expands Regional Delivery Services to More Than 20

Source : www.businesswire.com

Pitney Bowes Maps Blog: Introducing Last Mile Fleet Solution: Maximize fleet : Shipping firm Pitney Bowes Inc. agreed to liquidate much of its e-commerce business in bankruptcy as part of a pair of deals with Hilco Global and bondholder Oaktree Capital Management. Under the . Pitney Bowes Presort and SendTech segments are growing EBIT and misunderstood by the market. Post-GEC, Pitney Bowes should earn at least $1.27 per share by 2025 and should currently be valued over .